SHV has developed a robust approach to risk assessment and mitigation over recent years. Key business risks are regularly reviewed at both SHV and Group level to ensure they stay relevant in the face of ever-changing operating environments. We also continually optimize all related controls to monitor and manage specific risks as effectively as possible. The Groups are provided with clear guidance to maintain a consistent performance.

This chapter outlines our overall risk management framework, the key risks we face, and how we manage them on a day-to-day basis.

All Groups and their respective business units conduct comprehensive risk assessments using common rating and reporting criteria based on the SHV Risk Assessment Approach. The aim is to build a clear overview of key risks in terms of likelihood, impact, acceptance, and ability to mitigate. This in turn provides the basis for discussion at planning and strategy meetings, as well as a benchmark for the effectiveness of internal controls.

SHV Policies and Guidelines provide the Groups with clear direction on the standards expected from all colleagues. They not only support employees in conducting business better, but also guide us on the journey to becoming an ever more self-evaluating and faster learning organization.

The Business Support Framework (BSF) equips Groups with the key controls they need to monitor their performance in line with the SHV Policies and Guidelines. These controls are assessed throughout the year by the Groups themselves, as well as by internal control departments. Each Group is also required to reinforce this approach with business-specific key controls, which are evaluated against the latest key risks on an annual basis.

The Delivery & Development Agenda measures and monitors the execution of strategy, classifying key strategic elements into concrete topics. Delivery Agenda topics relate to execution-ready initiatives, whereas the Development Agenda focuses on areas that require further exploration before moving to the execution phase. This structured approach provides a solid framework for the analysis of current performance, as well as ongoing business developments.

A number of other programs also support the Groups in addressing key risks and strengthening the second-line monitoring of processes and control activities. In addition to the Ethics & Compliance framework discussed earlier, these initiatives include the SHV Information Security program (SISP), SHV Health & Safety Policy, and Minimum Global Standards for Project Management to name just a few.

As part of the annual risk management cycle, the Executive Board of Directors (EBD) and the SHV Functional Directors conducted a company-wide risk assessment over the course of 2024. The assessment set out to identify key risk areas, validate the effectiveness of internal control measures, and identify any actions required to mitigate risk within SHV parameters.

The results confirmed the company’s risk appetite as strategically open with a relatively cautious attitude to operations and finance. SHV remains steadfastly committed to safety, quality, and compliance.

This risk assessment was aligned with our Double Materiality Assessment, a cornerstone of Corporate Sustainability Reporting Directive (CSRD) compliant ESG reporting. By taking an outside-in perspective, which analyzes the impact of sustainability aspects on business performance, the risk assessment identified the key risks our organization currently faces.

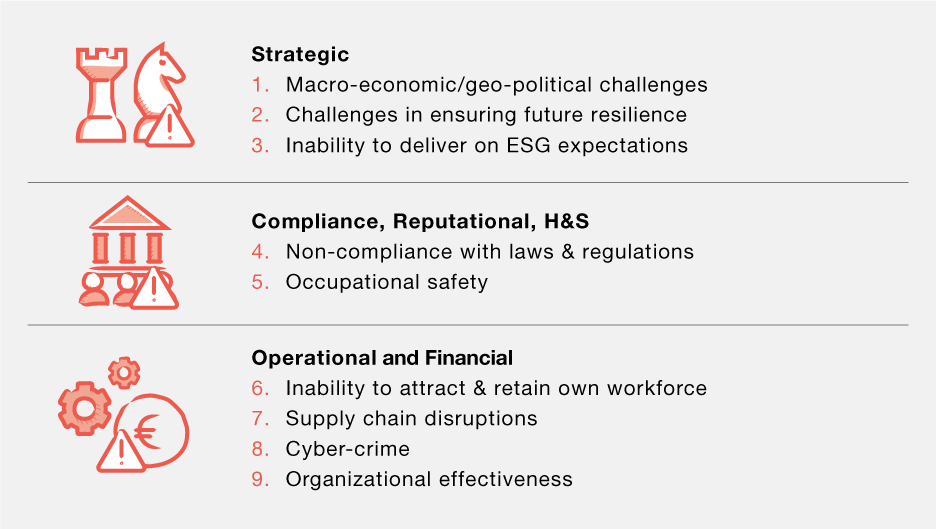

Strategic risks

Risk description | How the risk is managed |

|---|---|

SHV operates in 70 countries with varying degrees of political, legal, and fiscal stability. This exposes us to a wide range of global and regional risks. Regional conflicts, unstable regimes and inflationary pressure may hamper our global objectives, and potential armed conflicts may put our people’s safety in danger besides negatively affecting our business resilience. The growing tension due to regional conflicts can increase the prices of multiple commodities, leading to disruptions in our supply chain. Furthermore, the measures introduced by several countries to secure their economies could increase costs, which may in turn have a negative impact on our operational performance. | SHV and its Groups focus on the disciplined execution of strategic initiatives and the strengthening of market positions, together with an unwavering focus on controlling costs, managing working capital, cash flow, and improving margins. By operating in multiple regions, we can mitigate the impact of localized disruptions and leverage opportunities in more stable or growing markets. Our local businesses provide valuable insights and adaptability, enabling us to respond swiftly to changes in the macro-economic and geo-political landscape. This strategic diversification enhances our resilience and positions us to capitalize on global opportunities, supporting sustainable growth. With the increasing political unrest, macro-economic factors will continue to be felt over the coming years. SHV continuously monitors all developments and societal issues relevant to its interests. SHV and the Groups are committed to conducting business with integrity and operating in compliance with all applicable laws and regulations, guided by our Ethics & Compliance program and SHV Tax Policies.

|

Adapting to digital transformation by leveraging technology and applying technological developments is crucial for future resilience. Failure to do so may impact business resilience, effectiveness, and efficiency. Inadequate allocation of capital to responsible / future-proof investments may have adverse effects on operating cash flow, overall financial position, ability to attract capital, customers, suppliers and employees. Challenges in adapting to the energy and food transitions driven by shifting consumer preferences and regulatory changes may result in market share decline and loss of customer trust. | Agility remains a core element of the SHV Purpose, anchored in our People. We invest in comprehensive training and leadership development, enabling our workforce to build leadership qualities, adapt to change, and make decisions quickly. Together with the Groups, SHV cultivates an innovation-centric culture to drive organizational agility. Over the years, innovation has become an inherent part of the strategic agendas across the entire SHV Family of Companies. Data remains pivotal to the value proposition and the performance of all business units, wielding a strong influence over investments, Sales and Operations Planning (S&OP), and working capital. To meet increased reporting requirements such as CSRD and Pillar 2, SHV and the Groups prioritize data-driven risk insights and process automation through initiatives such as Pulse - the SHV Data Strategy Program led by Adaptfy, our integrated Data & Analytics (D&A) organization. SHV Holdings and the Groups also collaborate on the Better Together program. This aims to standardize IT services and lay the foundation for the digital initiatives that will help underpin business resilience, effectiveness, and efficiency. SHV concentrates on both organic and inorganic business growth. Inorganic growth depends on identifying the right targets for the Groups and investing in sustainable, long term value propositions. ESG is becoming an ever more integral part of business performance. SHV works with the Groups to focus on how ESG should be better reflected in strategy updates, delivery and development agendas, the rolling forecast, and investment proposals. Investment outcomes are also periodically assessed against the approved proposals, with learnings used to further improve the capital allocation process. |

SHV wants to ensure that its ESG ambitions are aligned with the business strategy as it is crucial for maintaining stakeholder trust and achieving long-term success. Otherwise, it can hinder our ability to meet societal demands and to secure long-term financing necessary for strategic initiatives. Failure to integrate ESG principles effectively into our operations may result in reduced confidence to our businesses and missed opportunities for sustainable growth. Also, non-compliance with ESG standards can attract ESG activism. This can result in campaigns against SHV, leading to reputational damage, possible litigation and potential loss of social license to operate. | Double Materiality Assessments (DMA), part of Corporate Sustainability Reporting Directive (CSRD), have defined the most relevant, ESG-related material topics for all Groups. Short - and longer - term targets have been set and action plans defined for each material topic. At SHV Holdings level, a consolidated DMA was conducted to ensure alignment of SHV-wide ESG ambitions with the business strategy of Group companies. CSRD implementation progress is monitored on a monthly basis during the EBD meetings with the focus on Climate change (E1), Own workforce (S1), Workers in the value chain (S2) and Corporate Governance (G1) topics. Action plans and the progress with related KPIs are reviewed with Groups as part of the Parent-Group meetings. This review forms part of the regular business review cycle and is integrated into existing processes across all functional areas. Implementation of CSRD is supervised by the steering committees at both SHV and Groups. This process adheres to SHV's minimum global standards of project management and applied by CSRD Program Managers and project teams. In this context, management's main focus is on transparency over the reliability of the data that will be subject to the sustainability reporting, aiming for limited assurance on the reports for key material topics identified through the DMA exercise. |

Compliance and Reputational risks

Risk description | How the risk is managed |

|---|---|

SHV operates across a diverse array of cultural environments, complex rules, and stringent regulations. While failure to comply with the rapidly evolving and expanding regulatory landscape can lead to fines, litigation, and reputational damage, we are committed to upholding the highest standards of business ethics. SHV’s organizational structure and its diverse operations also poses challenges in ensuring consistent policy implementation and compliance monitoring. This requires our Groups to continuously validate the extent to which our policies are integrated across all levels and how each business unit assesses and addresses potential non-compliance issues. | A comprehensive set of measures ensures that SHV and the Groups fulfill their commitment to conducting business with integrity and operating in compliance with all applicable laws and regulations. The SHV Ethics & Compliance Program focuses on Third Party Due Diligence, Anti-Bribery & Corruption, Sanctions and Trade Controls, Competition Law, Privacy, Data Protection and Whistle Blowing. The Ethics & Compliance (E&C) departments at both SHV and the Groups monitor emerging E&C trends in order to quickly respond to changing rules and regulations. In collaboration with Internal Audit, Legal, and Risk Management, all Groups need to adequately implement the E&C program elements and monitor performance against E&C key controls as defined in the Business Support Framework. |

Limited traction on safety programs and systems may result in the inability to provide a safe work environment, support employee well-being, and prevent safety incidents.

| Valuing the health and safety of all who work for and with SHV is a key part of our Purpose. Our ultimate goal is Zero Harm: everybody should return home safely every day. All Groups develop, document, and annually update their safety programs, which at the very minimum incorporate our three core initiatives: ■ Visible Felt Leadership ■ Life-Saving rules ■ Operational Discipline and Process Safety These initiatives are measured and monitored by senior management. |

Operational & Financial risks

Risk description | How the risk is managed |

|---|---|

Ensuring the right people are in the right roles, combined with effective workforce planning, supports SHV in achieving its strategic objectives. The challenge of attracting and retaining future skills, especially in a competitive and tight labor market in certain countries, poses a risk to building and maintaining a future-ready workforce. A structured leadership development approach and effective succession planning are crucial to sustaining organizational performance and ensuring the transfer of institutional knowledge. Without proactive measures to identify and nurture future leaders, SHV and its Groups may struggle to maintain continuity and achieve long-term strategic objectives. | Being seen as the employer of choice is playing an increasingly vital role in attracting and retaining the right workforce. SHV and the Groups undertake a number of initiatives to reinforce positive perceptions. This starts with a continuous learning approach to people development and leadership skills. SHV develops a structured leadership approach in close cooperation with the Group companies. Human-centred, futureproof programs promote an inclusive culture: for example, the ‘Management Essentials’ program focuses on a growth mindset, trust, psychological safety, and developmental feedback. Together with Groups, we continue to focus on Employee Value Proposition (EVP) exercises, high-quality onboarding, cross-Group job board accessible to all colleagues via SHV website and initiatives such as effective follow-up on succession management process which is planned for the various talent groups. In line with the CSRD program, policies and action plans are in place on topics like functional skills training and performance management throughout the organization. This program also gives us the opportunity to review the SHV leadership profile with the participation of various stakeholders to establish a dynamic leadership approach in line with SHV's Purpose and Values. |

Challenges in the supply chain due to disruptions and shortages in supply, inability to manage price increases and ineffective forecasting procedures could have a negative impact on our margins, quality of products and customer satisfaction. Both tariffs and sanctions disrupt international trade, leading to increased costs, and market volatility. The ambition to reduce carbon emissions increases the severity of supply chain disruptions (carbon taxes, cost of transition to lower carbon logistics, suppliers that cannot comply, scarcity of raw material needed for greener technology). | Ongoing geopolitical uncertainties mean supply chains remain complex, increasing the need to secure supplies from diverse regions and sources. SHV and the Groups are working to enhance the accuracy of forecasting and improve data flows between Groups and SHV Holdings to generate better business insights more quickly. Actions to minimize the impact of supply chain disruptions on operational risks include integrated business planning, improved supplier management, centralized procurement, and joint buying. With regards to carbon emissions, the main actions of our Group companies include diversification of the supplier base to reduce dependency on a single source as well as business partner code of conduct on adherence to sustainability principles. |

Cyberthreats and cybercrime are rapidly changing and continuously evolving. Also due to geopolitical risk developments, we see a wider spectrum of cyber-attacks. This increases the risk of disruptions in our operations, potentially harming our business and our client relationships. Increasing volumes of data also pose challenges to cyber resilience. | Beyond shielding the organization from cyberthreats, we are equally dedicated to detecting and quickly responding to any potential risks. Groups participate in cyber scenario simulations to practise and refine their responses to incidents. SHV Global IT and Group IT departments actively engage in the 'Better Together for Security' program, which addresses essential security topics and heightens our readiness to manage cyberthreats. |

Risk description | How the risk is managed |

|---|---|

To achieve its ambitious strategic initiatives, SHV requires an effective organization characterized by strong governance, an open and collaborative culture, and synergies across the organization. In a decentralized setup, the absence of such a culture among SHV and its Group companies may lead to a lack of process ownership and accountability, sub-optimal decision-making, and missed synergies. | SHV provides the Groups with consistent policies and control frameworks to bring clarity to the roles and responsibilities across the organization - including the role of SHV. Health of the control environment is checked via the enterprise risk management practices and functional programs that are applicable to all Group businesses. Through second and third lines of defence, functional risks are examined further by internal audit, internal control as well as ethics & compliance functions as needed. Certain cases are investigated, and learnings are shared across the organization. To remain a self-evaluating and fast learning organization, the Groups are also expected to implement a common approach by embracing the importance of process ownership and effective functional communities, which are essential to staying in control. |

Risks

Key risks

Macro-economic / geo-political challenges

Challenges in ensuring future resilience

Inability to deliver on ESG expectations

Non-compliance with laws & regulations

Occupational safety

Inability to attract and retain own workforce

Supply chain disruptions

Cybercrime

Organizational effectiveness